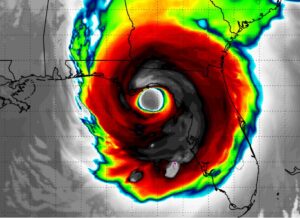

As Hurricane Helene batters the Gulf Coast, communities in Florida and surrounding areas are dealing with the severe aftermath. The destructive winds, heavy rainfall, and devastating storm surges have left a trail of damaged homes, businesses, and infrastructure. If you’ve been affected by Hurricane Helene, it’s essential to know how to file a damage compensation claim to cover your losses and secure your future.

Why Acting Fast is Crucial?

After a disaster like Hurricane Helene, time is of the essence when filing insurance claims. The longer you wait, the greater the risk of facing delays, complications, or even denial of your claim. In many cases, insurance companies require policyholders to file within a certain time frame, typically 60-90 days, depending on the policy.

During large-scale disasters, insurers are often overwhelmed with claims, which can lead to processing backlogs. That’s why it’s vital to begin the process as early as possible. Filing a well-documented claim promptly increases your chances of receiving the compensation you deserve.

Steps to Filing Your Hurricane Damage Claim

- Thoroughly Document the Damage Immediately after the storm has passed and it’s safe to do so, take detailed photos and videos of any damage to your property. This should include:

- Structural damage to your home or business.

- Broken windows, roof damage, or flooding.

- Damaged personal property such as furniture, appliances, or vehicles.

Keeping accurate records is critical. If possible, gather receipts for valuable items and compare pre-storm and post-storm conditions to strengthen your claim. These records will help prove the extent of the damage and can prevent any disputes down the line with your insurance company

- Contact Your Insurance Company ASAP After documenting the damage, report your claim to your insurance company immediately. This can usually be done via phone, online, or through their app. Make sure to confirm that your insurance policy covers hurricane-related damage, especially flood damage, which may require separate flood insurance. During this initial contact, make note of the following:

- The claim number.

- The representative’s name and contact information.

- A detailed summary of what was discussed.

Be proactive about following up on your claim as insurance companies may experience delays during peak filing periods after a major disaster like Hurricane Helene

- Mitigate Further Damage Insurance policies often require homeowners to take steps to prevent further damage. This means conducting temporary repairs like covering broken windows, tarping over roof damage, or removing water from flooded areas. Remember to keep receipts and document all emergency repairs, as these can be included in your claim for reimbursement. Avoid making permanent repairs until an insurance adjuster has assessed the damage

- Review and Understand Your Insurance Policy Hurricane insurance policies in Florida typically cover wind-related damages, but flood damage is often excluded unless you have a separate flood insurance policy. Make sure to carefully review the specifics of your policy to understand what is covered and any applicable deductibles. In some cases, hurricane deductibles are significantly higher than standard ones. Understanding these nuances can help you better prepare for discussions with your insurer and legal representatives.

Additionally, check whether your policy requires a sworn proof of loss—a detailed statement of the damage provided under oath—within a specific period after the disaster

Navigating Insurance Disputes

It’s common for insurance companies to delay or deny claims, especially in the aftermath of a large-scale disaster. You may be offered a low settlement, or your claim may be outright rejected. When disputes arise, it’s crucial to understand your rights as a policyholder. If your insurance company is acting in bad faith, such as unreasonably delaying or denying your claim, you may have grounds to take legal action.

At Minias Law Firm, we have extensive experience helping clients resolve insurance disputes. Our attorneys can review your policy, evaluate the damage, and negotiate with your insurer to ensure you receive the compensation you’re entitled to. If necessary, we’ll take your case to court to fight for your rights.

Special Considerations for Personal Injury and Workers’ Compensation

Beyond property damage, Hurricane Helene may have caused personal injuries due to falling debris, car accidents during evacuation, or workplace incidents in hazardous conditions. If you were injured during the storm, you may be eligible to file a personal injury or workers’ compensation claim.

For example:

- Injuries caused by structural collapses or unsafe conditions at your workplace can qualify you for workers’ compensation benefits.

- Injuries sustained while evacuating or seeking shelter may fall under personal injury claims, particularly if the injury resulted from someone else’s negligence.

Our experienced team at Minias Law Firm specializes in personal injury and workers’ compensation cases, ensuring our clients are compensated for their medical bills, lost wages, and emotional suffering.

Preparing for Future Hurricanes

As Floridians and Gulf Coast residents, we are no strangers to hurricane threats. In the wake of Hurricane Helene, it’s important to prepare for future storms by reassessing your insurance coverage, updating your emergency kits, and securing your property. Being proactive can reduce potential damages and help you recover faster from future storms.

At Minias Law Firm, we are here to guide you through the claims process and fight for your rights every step of the way. Whether you need assistance with a property damage claim, a personal injury case, or an insurance dispute, our dedicated team is ready to help.

Contact Us Today

If you’ve been impacted by Hurricane Helene, don’t wait to take action. The road to recovery can be long and difficult, but you don’t have to go through it alone. Minias Law Firm is here to help you secure the compensation you deserve. Contact us today for a consultation.